Markets

US Stocks Markets Climb on Hopes for Fed Pivot

US Stocks Markets investors found a possible silver lining: The rescue plan appears to shift—at least for now—the calculus on the path of the Fed’s interest-rate increases. Some investors are even hoping the central bank will cut interest rates this year, a sharp shift from before the bank meltdown and a move that would likely propel a rally in stocks.

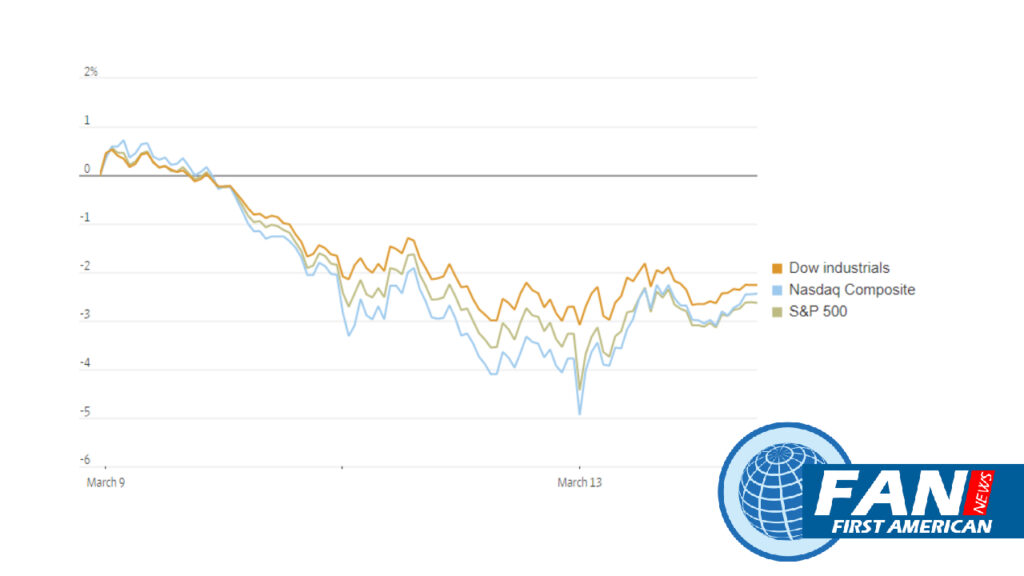

The S&P 500 was up 0.5% in afternoon trading, after opening down around 1%. The Dow Jones Industrial Average added 0.3%. The Nasdaq Composite rose 1%. Seven of the 11 sectors in the S&P 500 climbed, led by the utility and real estate groups.

Since Friday, derivatives traders have repriced the probability of interest-rate increases at next week’s Fed meeting. The most likely case at the coming meeting is for no increase, according to futures market bettors. Last week, they had expected a 0.50-percentage-point raise.

Goldman Sachs Group economists said they still expect rate increases in May, June and July, ultimately pushing interest rates to 5.25% to 5.5%.

Former Goldman Sachs Chief Executive Lloyd Blankfein said on Twitter that he sees a potential slowdown in Fed increases as a tailwind for markets.

“Anxiety and volatility [are] high, but sharply lower interest rates, Fed likely on hold, are strong positives for markets,” Mr. Blankfein said.

Get Wall Street Journal 2-Year Print Subscription for $480

The Treasury Department, the Fed, and the Federal Deposit Insurance Corp. guaranteed all deposits of SVB, which collapsed after an attempt to raise capital led to a bank run. Regulators also said they had taken control of Signature Bank, which serves many cryptocurrency companies.

The moves initially appeared to shore up wavering confidence in the American banking system.US Stocks Markets futures ticked higher overnight, before selling intensified in European trading. Major stock indexes in the U.S. opened in the red before flipping higher.

“When the Fed raises rates so quickly, nine times out of 10, it breaks things. We may see more corporate failures, we may see more regional banks go under,” said Edward Smith, co-chief investment officer at Rathbones.

Yields on government bonds on both sides of the Atlantic dropped sharply and trading in several regional bank stocks was halted for volatility shortly after the opening bell.

The yield on the 2-year Treasury bill dropped to 4.082% from 4.586%, its largest single-day decline since 2001. The yield on the 10-year U.S. Treasury note fell to 3.474%, from 3.694% Friday. Bond yields fall as prices rise.

Regional bank shares plummeted, with investors’ confidence shaken. Larger banks fared better, but the S&P 500’s financial sector was still off 3.5% in afternoon trading.

Get Wall Street Journal 2-Year Print Subscription for $480

First Republic shares were halted for volatility after plunging 65% in morning trading, despite an agreement for additional financing from JPMorgan Chase on Sunday. Shares of PacWest Bancorp, Zions Bancorp, and Regions Financial were also halted for volatility.

First Republic, Western Alliance Bancorp, and Metropolitan Bank were the worst performers in the US Stocks Markets, all dropping by more than 40%. The KBW Bank Index, which tracks 24 leading banks, tumbled 11%. Wall Street’s fear gauge—the Cboe Volatility Index—jumped to its highest in five months, at 26.88.

“Maintaining depositor and investor confidence is crucial for a financial institution, and we cannot completely rule out the possibility that other banks could face similar concerns, despite what appear to be very sound balance sheets across the industry,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management.

Europe’s pan-continental Stoxx Europe 600 Index declined 2.4% in its worst day of the year so far, with the banking sector leading losses. Shares of Commerzbank and Credit Suisse both fell around 10%.

The yield on the benchmark 10-year German bond fell to 2.177%, from 2.467% Friday.

Cryptocurrency prices gained, with bitcoin up 3.2% from its 5 p.m. ET level Sunday to trade around $22,075 apiece.

Get WSJ Print Edition Subscription for $245

The dollar weakened against major currencies as rate increase expectations fell. The WSJ Dollar Index, which tracks the greenback against a basket of currencies, fell 1%.

In Asia, Japan’s benchmark Nikkei 225 ended the day down 1.1%. Chinese stocks rose both on the mainland and in Hong Kong. The Hang Seng Index, which is heavily weighted toward banks and technology companies, rose 1.9% and the CSI 300 index ended 1% higher. Dozens of Chinese companies, many in the healthcare sector, issued statements over the weekend saying that their exposure to SVB was immaterial.